14.03.2025

Dubai property analysis: Key metrics every investor should consider

Understanding the key metrics for Dubai property investment is essential for successful real estate investment in a rapidly evolving market, where towering developments and innovative projects continuously reshape the skyline.

Navigating this dynamic landscape requires not just market insight but a methodical evaluation of investment performance. This article provides a comprehensive Dubai real estate market analysis, equipping investors with the critical metrics that drive strategic decision-making and unlock the market's potential. In essence, it serves as a complete Dubai real estate investment guide for discerning investors.

10 Real Estate Valuation Methods in Dubai You Should Know

1. ROI and ROE: fundamental indicators

Return on Investment (ROI)

ROI is a cornerstone metric that evaluates the profitability of an investment by comparing net gains to the initial capital outlay. In the context of Dubai’s property market, ROI provides a clear indication of how effectively an investment generates returns. The standard formula for ROI is:

ROI = (Net Profit / Initial Investment) x 100%

For example, if an investor in Dubai purchases a property for AED 800 000 and realizes a net profit of AED 80 000 after accounting for expenses, the ROI would be 10%. Key factors influencing ROI in Dubai include location prestige, the type of property, rental yield, and prevailing market conditions.

Return on Equity (ROE)

ROE measures the profitability relative to the amount of equity invested, offering insight into how effectively investor capital is being utilized. This metric is particularly significant in Dubai where leveraging equity through various financing options is a common practice. The ROE is calculated as:

ROE = (Net Income / Shareholder’s Equity) x 100%

Consider an investor acquiring an apartment in Dubai Marina with a total property price of AED 2 000 000. The investor finances the purchase with a 40% down payment, amounting to AED 800 000 in equity, while the remaining AED 1 200 000 is secured through a mortgage. Over the first year, after deducting mortgage interest and operating expenses, the net profit generated stands at AED 100 000. The Return on Equity (ROE) is then calculated as follows:

ROE = (AED 100 000 / AED 800 000) × 100 = 12,5%

This example underscores how leveraging a relatively modest equity contribution can amplify performance metrics — a particularly pertinent consideration in Dubai’s competitive property market.

ROI vs. ROE in Dubai properties

While ROI provides a broad view of investment profitability, ROE offers a more nuanced understanding of performance relative to the investor’s capital. In scenarios where financing plays a pivotal role — common in Dubai’s property market — ROE becomes particularly informative. Investors should use ROI to gauge overall profitability and ROE to determine the effectiveness of leveraging their equity.

2. Capitalization Rate (Cap Rate)

The real estate Cap Rate in Dubai** **is indispensable for assessing a property's income-generating potential relative to its market value. Defined as the ratio of Net Operating Income (NOI) to the property’s value, it offers investors a standardised means of comparing disparate assets:

Cap Rate = (NOI / Property Value) × 100

Consider an investor purchasing a rental apartment in Business Bay for AED 2 500 000. The property generates an annual rental income of AED 180 000, and after deducting operating expenses — such as maintenance, service charges, and property management fees — of AED 30 000, the Net Operating Income (NOI) stands at AED 150 000. The capitalization rate (Cap Rate) is calculated as follows:

Cap Rate = (AED 150 000 / AED 2 500 000) × 100 = 6%

Thus, the Cap Rate calculates to 6%, positioning the property as a mid-range investment in Dubai. In premium areas like the Palm Jumeirah investors may yield 4–5%, reflective of their stable income streams and lower associated risk.

By contrast, emerging districts such as Dubai South can offer cap rates of 6–8%, offering potentially higher returns at a commensurately higher risk.

3. Gross Rental Yield

Gross Rental Yield measures the annual rental income before expenses as a percentage of the property’s purchase cost, serving as a direct indicator of income potential:

Gross Rental Yield = (Annual Rental Income / Property Cost) × 100

For example, a property purchased in Jumeirah Village Circle for AED 1 000 000 that generates AED 80 000 in annual rent would yield:

Gross Rental Yield = (AED 80 000 / AED 1 000 000) × 100 = 8%

This metric is particularly significant for investors targeting high-yield properties and top rental areas, where rental yield in Dubai remains robust.

4. Cash-on-Cash Return

Cash-on-Cash Return (CoC) in Dubai real estate measures annual pre-tax cash flow relative to the initial cash investment, making it particularly relevant for investors leveraging mortgages. Unlike ROI, which considers total property value, CoC focuses on the investor’s actual cash contribution.

Consider an investor purchasing an apartment in Dubai Marina for AED 1 500 000, financing 50% of the purchase price with a mortgage and paying the remaining AED 750 000 as a down payment.

The property generates AED 120 000 in annual rental income, while operating expenses, including service charges and maintenance, total AED 20 000. The investor’s mortgage payments — covering both interest and principal — amount to AED 60 000 per year. After deducting these costs, the net cash flow stands at AED 40 000.

Applying the cash-on-cash return formula, the investor divides net cash flow by the initial cash investment:

CoC Return = (Net Cash Flow / Initial Cash Investment) × 100

CoC Return = (AED 40 000 / AED 450 000) × 100 = 8,9%

A return of 8,9% signals a strong cash-generating investment, particularly for a leveraged property. Unlike return on investment, which considers the property’s total value, cash-on-cash return focuses solely on the actual cash invested, making it a more practical metric for investors evaluating real estate financing strategies.

5. Debt Service Coverage Ratio (DSCR)

The Debt Service Coverage Ratio (DSCR) is a critical metric in Dubai’s real estate financing landscape, assessing a property’s ability to cover its debt obligations using its income (NOI).

Net Operating Income (NOI) is a property's total income from rent and other sources, minus operating expenses, but before deducting mortgage payments and taxes.

An investor purchasing a serviced apartment in Downtown Dubai with an NOI of AED 300 000 and an annual mortgage payment of AED 200 000 would calculate DSCR as follows:

DSCR = Net Operating Income (NOI) / Total Debt Service

DSCR = AED 300 000 / AED 200 000 = 1.5

A DSCR of 1.5 suggests that the property’s income exceeds debt obligations by 50%, making it an attractive option for lenders — a crucial benchmark in Dubai property returns analysis.

Generally, Dubai banks require a DSCR of at least 1.25 for mortgage approval, though stronger ratios above 1.5 indicate lower financial risk and greater income stability.

If DSCR falls below 1.0, the investment is not generating enough to cover its loan obligations, requiring additional capital to bridge the gap.

6. Operating Expense Ratio (OER)

The Operating Expense Ratio (OER) in Dubai is a key metric for evaluating the efficiency of a property’s management by expressing operating costs as a percentage of gross income.

A lower OER indicates better cost control and higher profitability, making it a crucial factor for investors assessing rental properties in Dubai. The formula for calculating OER is:

OER = (Operating Expenses / Gross Rental Income) × 100

Consider a rental property in Jumeirah Lakes Towers generating an annual rental income of AED 300 000. The owner incurs AED 60 000 in expenses, including service charges, maintenance, property management fees, and utilities.

OER = (AED 60,000 / AED 300,000) × 100 = 20%

A 20% OER suggests that only a small portion of rental income is consumed by expenses, leaving a healthy margin for profitability. In Dubai, OERs typically range between 20% and 35%, with well-managed properties in premium areas achieving lower ratios. Keeping OER under control through cost-efficient property management and tenant retention strategies ensures stronger investment returns over time.

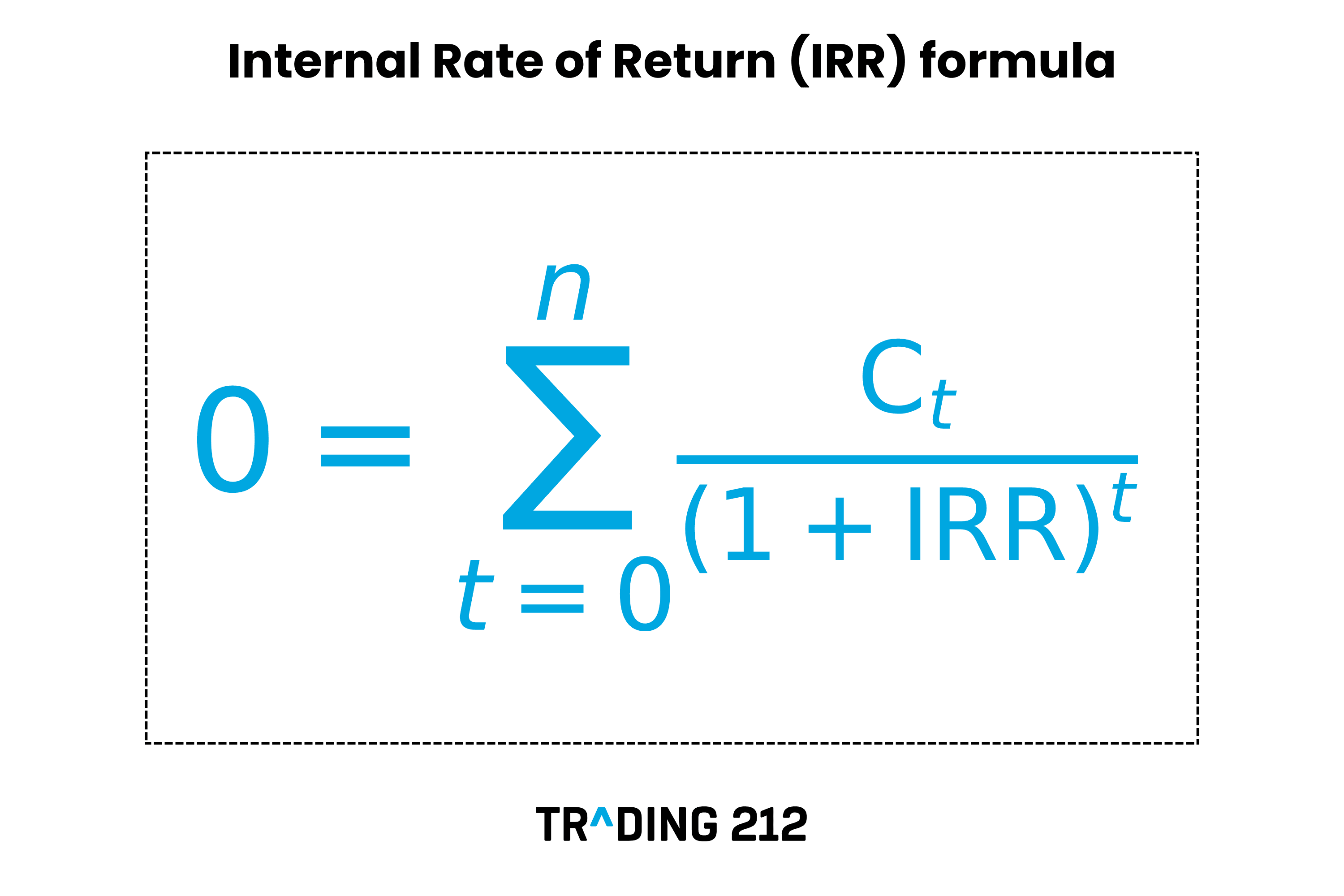

7. Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) for Dubai property investment is a powerful tool for assessing long-term profitability. Unlike simpler yield metrics, IRR accounts for the time value of money, making it an essential tool for comparing investment opportunities with varying cash flow structures.

The IRR is the discount rate at which the Net Present Value (NPV) of all future cash flows equals zero. It represents the effective annual return an investor can expect on a property over time.

The formula for IRR is based on the NPV equation:

NPV =∑ Ct(1 + IRR)t=0

Where:

- Ct = Cash flow at time t

- t = Time period (year)

- IRR = Internal Rate of Return

To illustrate, consider an investor purchasing a serviced apartment in Downtown Dubai for AED 2 000 000. The property generates AED 120 000 in net rental income annually. After five years, the investor sells the property for AED 2 500 000.

The series of cash flows is as follows:

- Year 0: -2,000,000 (initial investment)

- Year 1–4: +120,000 (rental income)

- Year 5: +2,620,000 (rental income + sale price)

Using financial calculations, the IRR for this investment is approximately 10.1%.

In Dubai’s real estate market, IRR expectations typically range between 8% and 15%, depending on location, asset type, and market conditions. Higher IRRs indicate stronger profitability and efficient capital allocation, making this metric essential for assessing off-plan projects, rental assets, and long-term appreciation potential.

8. Location-specific metrics

In Dubai’s real estate market, location remains the most influential factor shaping investment outcomes. Key metrics such as ROI, gross rental yield, and Cap Rate fluctuate significantly based on geographic positioning, infrastructure quality, and future development plans.

Prime areas like Palm Jumeirah, Downtown Dubai, and Dubai Marina are characterised by high demand, price stability, and lower rental yields due to premium valuations. Investors prioritise these areas for long-term capital appreciation and lower risk exposure, even if immediate yields are relatively modest.

By contrast, emerging districts such as Dubai South, Jumeirah Village Circle, and Arjan are the best areas for investment in Dubai,** **which often deliver higher rental yields and Cap Rates, reflecting their lower entry prices and potential for growth.

However, these areas come with greater market volatility and a reliance on future infrastructure improvements to sustain long-term value appreciation.

The presence of transport links, commercial hubs, and lifestyle amenities plays a crucial role in dictating real estate performance. Proximity to metro stations, major highways, and business districts enhances both rental demand and resale potential.

Meanwhile, large-scale projects such as Dubai Expo City and the expansion of Al Maktoum International Airport are set to transform investment landscapes in surrounding areas, reinforcing the importance of forward-looking market assessments.

9. Property-specific metrics

Beyond location, the physical and financial profile of the property plays a decisive role in investment success.

The type of asset, its condition, and associated costs directly influence risk, returns, and long-term profitability.

- Off-plan properties offer lower purchase prices and flexible payment plans, making them attractive for capital appreciation. However, they come with completion risks and potential market fluctuations before handover.

- Ready properties provide immediate rental income and are generally more stable investments, but they may require a higher upfront capital outlay.

- Luxury real estate commands strong capital appreciation, though it often yields lower rental returns due to high purchase costs.

- Affordable housing tends to offer higher rental yields, yet requires careful tenant selection and maintenance management to ensure profitability.

- Newer developments generally have lower maintenance costs, whereas older properties may demand renovations that erode net returns.

Legal and maintenance costs vary widely and impact net returns. Annual service charges, maintenance fees, and regulatory costs must be factored into calculations to ensure a sustainable investment strategy.

Developer reputation is crucial for resale value and rental demand. Properties built by Mira Developments typically retain their value better and attract stronger buyer confidence.

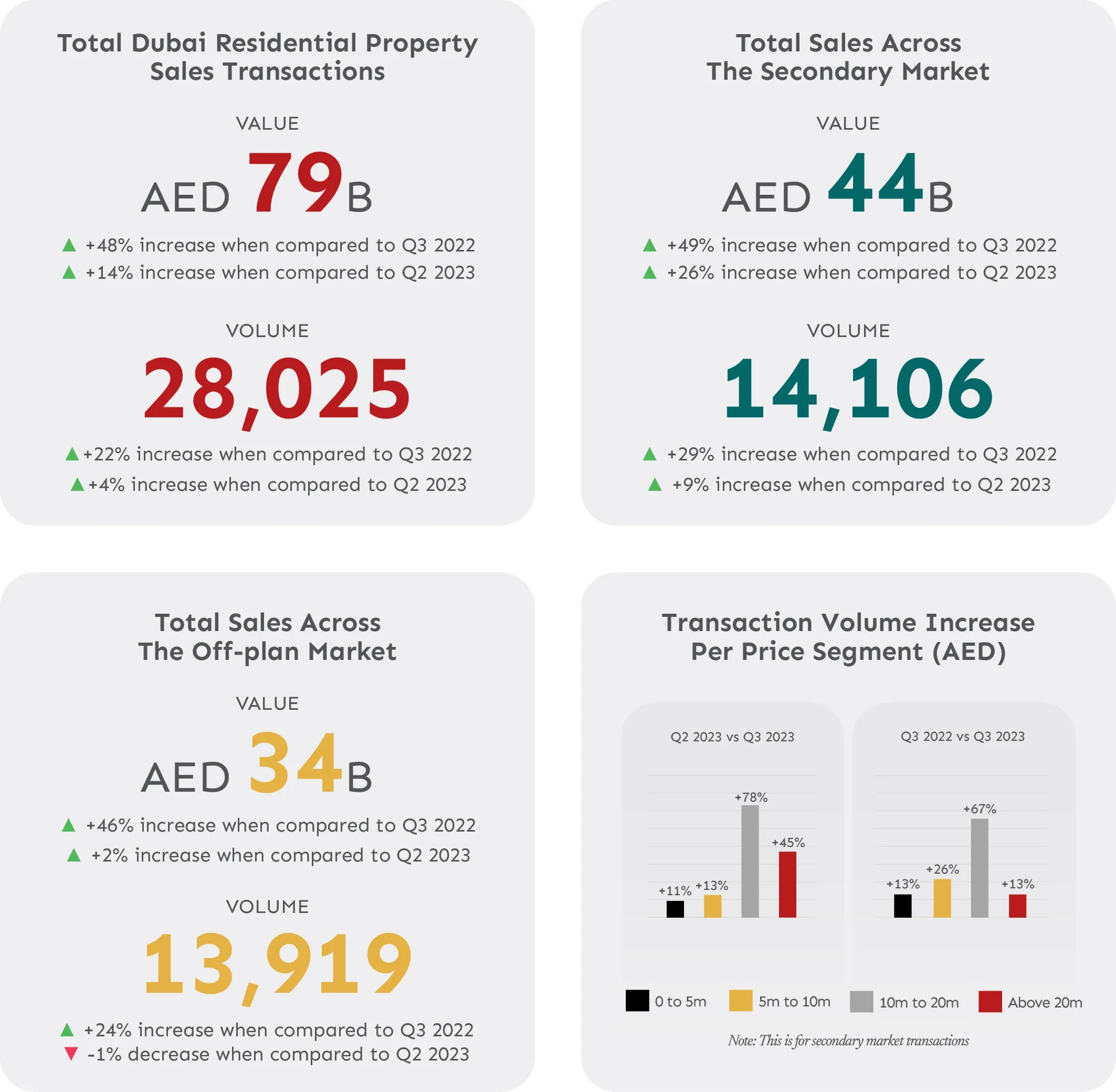

10. Market trends and economic indicators

In 2024, Dubai’s property market continued to grow, driven by robust demand. According to CBRE’s Q3 report, house prices have surged by 20% year-on-year, underscoring the importance of comprehensive Dubai real estate investment metrics.

Meanwhile, economic fundamentals remain equally robust. Bolstered by progressive government policies and recent visa reforms, Dubai’s population has reached 3,8 million in 2024 and is projected to climb to 5,8 million by 2040, largely due to an influx of expatriates.

The International Monetary Fund forecasts that the UAE’s real GDP will grow by 5.1% in 2025, significantly outpacing the anticipated growth rates in the US and EU, which are expected to expand by 2,2% and 1,6% respectively.

These macroeconomic trends, combined with a dynamic local market, are creating a highly favorable environment for real estate investment, offering strong potential for capital appreciation and rental yield growth.

Conclusion

A comprehensive understanding of metrics such as ROI, rental yield, and Cap Rate offers a clear roadmap for navigating Dubai’s property investments. Utilizing a combination of these metrics allows investors to undertake a holistic analysis, capturing both immediate income potential and long-term growth prospects.

In this dynamic market, it is essential to seek expert guidance, employ professional valuation tools, and stay current with emerging trends. MIRA Developments exemplifies this approach, offering valuable insights into the local landscape.

Whether you are exploring real estate investment in Dubai, considering a project like Mira Villas designed by Bentley Home, or interested in luxury apartments at Trussardi Residences, maintaining an informed and agile strategy is crucial for capitalising on the opportunities ahead.

Explore Our Projects

Al Marjan Island, Ras Al Khaimah, UAE

Gianfranco Ferré Residences

Step into a new standard of coastal living with stylish studios and spacious one-, two-, and four-bedroom apartments — all featuring fully furnished interiors, hotel-style services, and sweeping views of the Arabian Gulf.

Tbilisi, Georgia

Trussardi Residences, Mira Verde

Set within the Mira Verde community, Trussardi Residences brings the refined Milanese design philosophy to Georgia for the first time, surrounded by the green landscapes of Tbilisi Hills.

Al Furjan, Discovery Gardens, Dubai, UAE

Trussardi Residences Phase II

Following overwhelming demand for Phase I, these two towers present an even more refined and upgraded offering, infused with the same Milanese spirit.

Andermatt, Switzerland

POST Hotel & Residences by ELIE SAAB

The project transforms the historic chalet in the Swiss Alps into a pinnacle of modern comfort and sophistication.

Tbilisi, Georgia

Mira Verde

Georgia’s first branded, master-planned community, set amid the rolling green landscapes of Tbilisi Hills, just ten minutes from the historic city center.

Al Mairid, Ras Al Khaimah, UAE

Mira Coral Bay

Mira Coral Bay is the world’s first luxury waterfront community, created in partnership with 14 globally renowned brands, on the picturesque shores of Ras Al Khaimah.