27.02.2025

How to get UAE residency visa with property investment in 2025

Few countries grant residency in exchange for buying property, and among those that do, Dubai offers remarkably flexible options.

The emirate’s reputation as a global hub for innovation, luxury, and opportunity is beyond doubt. Its progressive government policies encouraging investment and the flourishing real estate market with consistent and rising returns are the two primary reasons that explain its attraction to foreign investors.

If you’ve ever wondered how buying property in Dubai can secure you residency, this guide is for you.

Residency Through Real Estate: An Overview

The real estate boom for foreign buyers began in 2002, when Dubai introduced freehold property ownership for foreigners, allowing investors to purchase property in designated freehold areas. Since then, the city has expanded its offerings, introducing residency visas tied to real estate investment. These visas offer expats a unique opportunity to settle down legally in Dubai and enjoy the rewards of their property investments.

Currently, Dubai offers several residency visa options linked to property ownership.

1. Property Value and Visa Types

For foreigners looking to invest in UAE real estate, the government offers property investor visas with varying durations, based on the value of the investment:

-

Two-year investor visa: Requires a property investment of at least AED 750,000. Renewal is required every two years to comply with visa terms.

-

Three-year residence visa: Requires a minimum investment of AED 1,000,000 in property.

-

Five-year investor visa: For investments of at least AED 5 million, retained for a minimum of three years.

-

Ten-year Golden Visa: Available for investments totaling AED 10 million, with 40% allocated to real estate. These visas allow expat investors to:

-

Sponsor dependents, including family members.

-

Access essential services, including healthcare and education, get a driver’s license.

-

Enjoy the whole range of benefits from long-term residency.

2. Property Ownership Structure

While sole ownership is the simplest route towards residency, joint ownership with a spouse is allowed, on condition the property’s total value meets the visa threshold. An attested marriage certificate is required to validate this arrangement.

In case of joint ownership with someone other than a spouse, each party’s share must individually meet the required value.

3. Mortgage Financing

Financing options vary by visa type. Two-year visas allow properties purchased through leverage, while five- and ten-year visas require properties to be paid in full and owned outright.

4. Proof of Income

Applicants for residency visas must be able to demonstrate a steady income:

- Two-year visa: AED 10,000 per month.

- Five-year visa for retirees: AED 20,000 per month.

Step-by-step guide to securing residency

Following is the detailed outline of the process to secure a residency visa through property investment:

1. Purchase a Property

Select a property in a freehold zone that meets the value criteria. Ensure the property is ready for handover, and register it with the Dubai Land Department (DLD).

2. Gather Required Documents

Prepare the following:

- Passport and recent photos.

- Title deed for the property.

- Bank statements.

- Proof of income.

- No Objection Certificate (NOC) from the bank (if mortgaged).

- Medical insurance.

- Police clearance certificate

- A certificate of good conduct issued by the Emirate of Dubai and addressed to the Land Department

3. Complete Medical Examination

Visit a government-approved medical center for a fitness test, a mandatory step for all visa applicants. The whole process rarely exceeds 1.5 hours, including filling out the required paperwork.

4. Apply for Residency

Submit your application through the DLD’s immigration section. Ensure all documentation is accurate and complete to avoid delays.

5. Receive Your Visa

Once approved, you’ll receive your residency visa, granting access to a range of benefits, including the ability to sponsor family members. The wait time is normally 7 to 10 days.

Benefits of Real Estate-Linked Residency

Investing in property for residency comes with numerous advantages. Here are the most important ones:

1. Long-Term Stability

Dubai’s residency visas offer renewal options, allowing expats to plan for a secure future in the UAE. The ability to sponsor dependents adds further value, making this an appealing option for families.

2. High Rental Yields

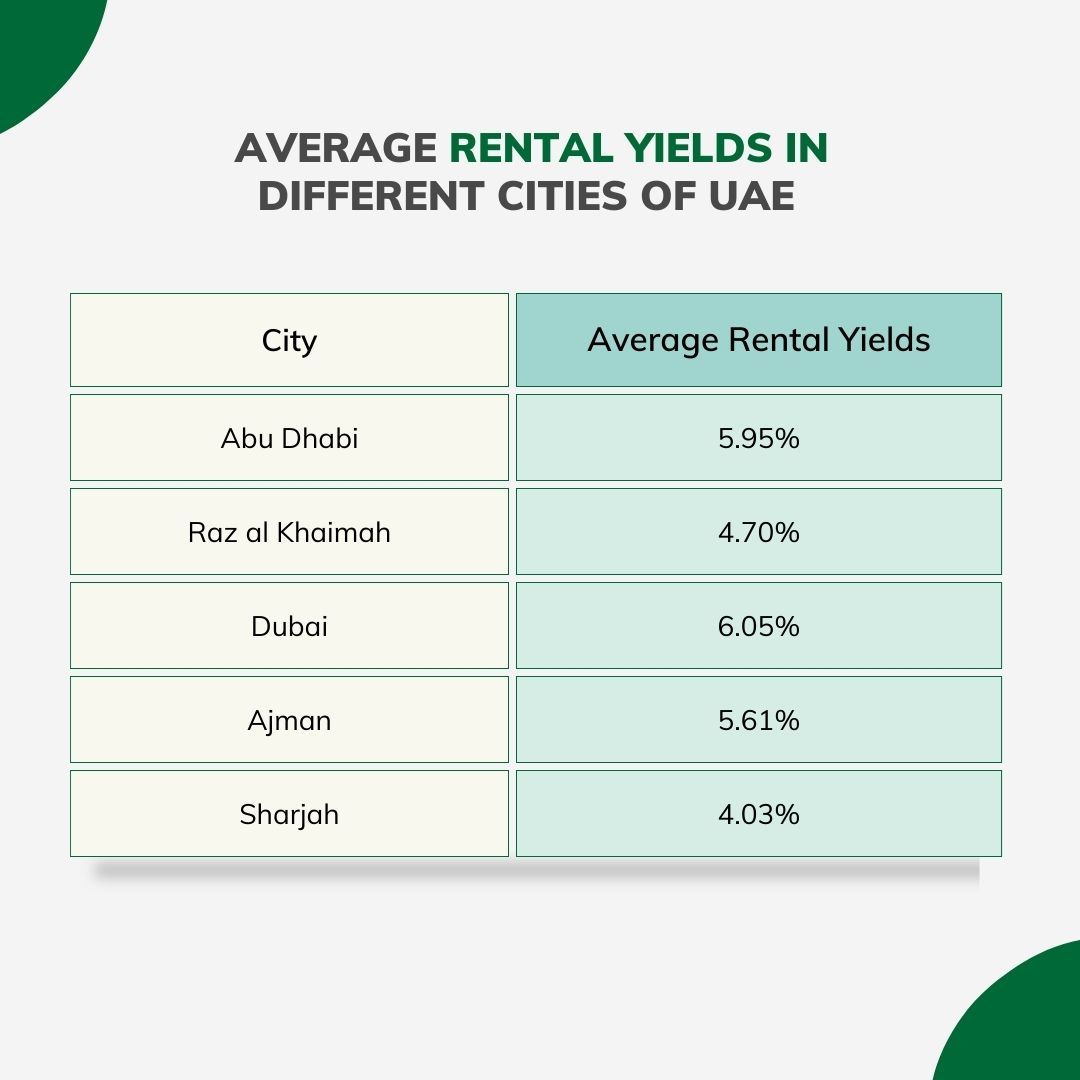

Dubai’s real estate market consistently delivers impressive returns. Properties in sought-after areas like Palm Jumeirah, Downtown Dubai, and Jumeirah Village Circle (JVC) yield rental incomes averaging 6-9% annually.

3. Golden Visa Perks

The ten-year Golden Visa enables investors to reside in Dubai long-term, sponsor dependents, and benefit from exclusive privileges, such as extended travel flexibility. If you own a business, you can also sponsor an executive director and advisor with this visa.

4. Tax-Free Benefits

With no income or capital gains tax, Dubai provides an ideal environment for investors looking to maximize returns.

Recent Updates and Flexibility

The UAE’s property investment regulations are constantly evolving to accommodate diverse investor needs. Key updates include:

- Multiple property purchases: Combine up to three properties to meet visa thresholds.

- Gifted properties: Properties gifted to an individual, with a value exceeding AED 750,000, now qualify for residency.

- Mortgage-friendly options: The ability to secure a visa for mortgaged properties adds convenience for buyers.

Common Misconceptions

- Residency through off-plan properties Off-plan properties do not qualify for residency until a title deed is issued. Ensure your chosen property meets all legal requirements.

- Employment restrictions Residency visas linked to property investment do not permit employment. Separate work visas and permits are required for those seeking employment in the UAE.

- Automatic residency Property ownership does not guarantee residency; the application process must be completed separately through the appropriate channels.

Tips for Investors

- Engage professionals: Work with licensed real estate agents and legal advisors to navigate the process seamlessly. Mira Developments has all the resources to help you find the property tailored to your needs and budget.

- **Understand **freehold zones: Focus on areas offering high rental yields and long-term appreciation, such as Downtown Dubai, Dubai Hills Estate, and other hotpots.

- Leverage property management services: Simplify leasing and maintenance by partnering with a reliable property management firm.

Takeaway

Securing residency in Dubai through property investment is a strategic decision that combines financial benefits with the city’s unmatched lifestyle.

Whether opting for a short-term two-year visa or the prestigious ten-year Golden Visa, Dubai’s evolving policies offer opportunities for investors at every level.

With the flexibility to invest in multiple properties, access to world-class amenities, and high rental yields, Dubai’s real estate market is a gateway to both prosperity and residency. Start your journey today and unlock the endless possibilities that come with calling Dubai home.

Explore Our Projects

Al Marjan Island, Ras Al Khaimah, UAE

Gianfranco Ferré Residences

Step into a new standard of coastal living with stylish studios, 1 — 2 bedroom apartments and spacious 2–4 bedroom duplexes — all featuring fully furnished interiors, five-star hotel-level services and sweeping views of the Arabian Gulf.

Tbilisi, Georgia

Trussardi Residences, Mira Verde

Set within the Mira Verde community, Trussardi Residences brings the refined Milanese design philosophy to Georgia for the first time, surrounded by the green landscapes of Tbilisi Hills.

Discovery Gardens, Al Furjan, Dubai, UAE

Trussardi Residences Phase II

Following overwhelming demand for Phase I, these two towers present an even more refined and upgraded offering, infused with the same Milanese spirit.

Andermatt, Switzerland

POST Hotel & Residences by ELIE SAAB

The project transforms the historic chalet in the Swiss Alps into a pinnacle of modern comfort and sophistication.

Tbilisi, Georgia

Mira Verde

Georgia’s first branded, master-planned community, set amid the rolling green landscapes of Tbilisi Hills, just ten minutes from the historic city center.

Al Mairid, Ras Al Khaimah, UAE

Mira Coral Bay

Mira Coral Bay is the world’s first luxury waterfront community, created in partnership with 14 globally renowned brands, on the picturesque shores of Ras Al Khaimah.